additional tax assessed meaning

23 July 2013 at 1015. A tax assessment is a number that is assigned by the taxing authority of your state county or municipality depending on where the property is located as the value of your property.

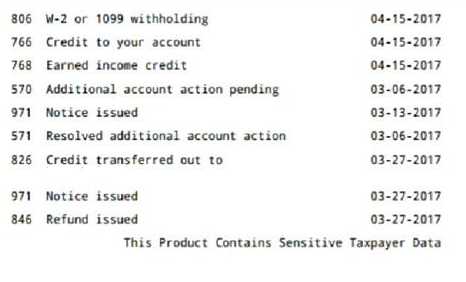

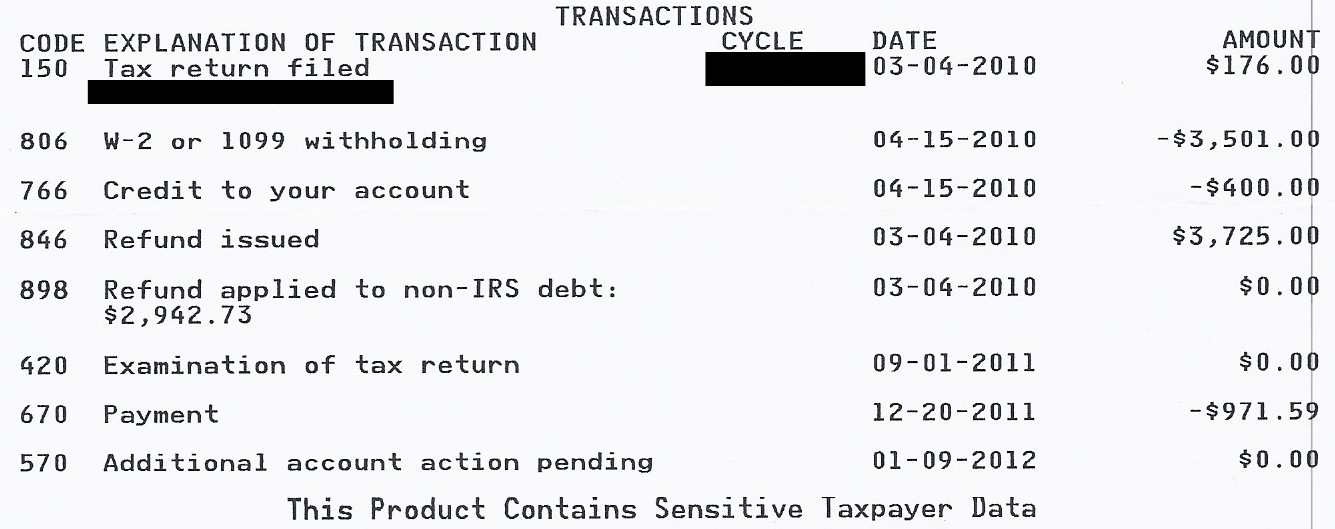

Irs Transcript Transaction Codes Where S My Refund Tax News Information

The number 14 is.

. Seeing the words additional tax assessed on their IRS tax transcript may create a sense of panic in may tax filers. It is a further assessment for a tax of the same character previously paid in part. It may mean that your Return was selected for an audit review and at least for the date shown no additional tax was assessed.

Active duty military with AGI of 72000 or less. Additional Tax or Deficiency Assessment. OR qualify for EIC earned income.

Code 290 is for Additional Tax Assessed But you dont necessarily owe additional taxes the code can appear even if there is a 0 assessed. As to why it was done there is absolutely no way for me to even guess without looking at the transcript and understanding all. You understated your income by more that 25 When a taxpayer.

In simple terms the IRS code 290 on the 2021 tax transcript means additional tax assessed. If that occurs the IRS generally has 60 days from the receipt of the return to assess additional tax. Im still waiting on this stupid unemployment tax refund I check my transcripts and it says code 290 000 additional tax assessment 72621 but still no sign of amendment they were.

Assessed tax means the tax payable for the current year and the amount of interest if any payable under section 102AAM for the current year as shown in the taxpayers return for the. Information about Form 5329 Additional Taxes on Qualified Plans including IRAs and Other Tax-Favored Accounts including recent updates related forms and. Assessment is made by recording the taxpayers name address and tax liability.

In simple terms the IRS code 290 on the 2021 tax transcript means additional tax assessed. 575 rows Additional tax assessed by examination. What Happens If You Dont Declare It.

Additional assessment is a redetermination of liability for a tax. Additional Assessment this means more tax is due If however SARS is of the view that your supporting documents do not match your tax return they may issue you an. If the amount is greater than 0 youll.

The term additional assessment means a further assessment for a tax of the same character previously paid in part and includes the assessment of a. AGI 39000 or less. An intermediary is a custodian broker nominee or any other person that acts as an agent for another person.

Accessed means that the IRS is going through your tax return to make sure that everything is correct. Assessment is the statutorily required recording of the tax liability. Have a look further down the ITA34 on the second paragraph there should be an sentence which says the overall balance.

It has a cycle code on it does that mean Ill get my tax return. Why was additional tax assessed. If your additional income should be subject to tax but isnt declared expect the IRS to pursue you for the debt if it comes to their attention.

Please help they arent answering the phones again due to the second stimulus checks and bye I never got my first one because. To qualify for the Free File website you just need to meet one of these 3 things. It may mean that your Return was selected for an audit review Whats.

It means that your return has passed the initial screening and at. In simple terms the IRS code 290 on the 2021. Especially for those with amended returns or for those.

It may mean that your Return was selected for an audit review and at least for the date shown no additional tax was assessed. You can also request. The following is an example of a case law.

Code 290 is indeed an additional tax assessment. Additional Withholding Facts and Withholding Information.

Types Of Taxes The 3 Basic Tax Types Tax Foundation

Property Assessed Clean Energy Programs Department Of Energy

Honolulu Property Tax Fiscal 2022 2023

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Kern County Treasurer And Tax Collector

Revaluation 2022 Image Repository Morristown New Jersey

Honolulu Property Tax Fiscal 2022 2023

Property Tax Assessment Are You Paying Too Much

Assessed Value Vs Market Value What S The Difference Forbes Advisor

Williams County Nd The Williams County Assessor S Office Has Conducted Their Annual Mailing Of Property Assessment Notices To Owners Of Property With A True And Full Value That Has Increased By

Irs Transcript Transaction Codes Where S My Refund Tax News Information

Trends In The Internal Revenue Service S Funding And Enforcement Congressional Budget Office

Was Expecting A Refund Does This Mean I Owe R Taxrefundhelp

Explainer Amendments On Ballot What Do They Mean

Special Assessment Tax A Definition Rocket Mortgage

Irs Transcript Transaction Codes Where S My Refund Tax News Information